By : THANE STENNER; Special to The Globe and Mail

Published Last updated

As the year draws to a close, it’s time to take stock of the year that was, and to think about what worked, what didn’t and why.

This year, it isn’t exactly obvious what has “worked” – because not a lot has. Everyone knows what hasn’t worked, however: energy (specifically, oil and gas) and materials (base metals, lumber, soft commodities, etc.). And the reason has been easy to understand. Simply put, there’s too much supply, and not enough demand.

To call performance in these sectors “abysmal” would be an understatement; investors in both these areas have been decimated. That’s particularly important here in Canada, where an outsized portion of our stock market is in energy and materials.

While the devastation in the oil patch has started to create opportunities, I’d like to leave that topic for another time, and instead focus on materials, a sector that I believe is beginning to look exceptionally attractive for disciplined contrarian investors.

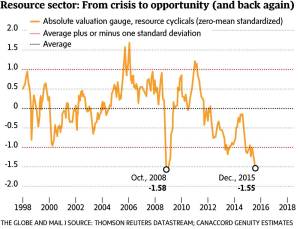

To put the current “resource rout” in perspective, consider the accompanying chart, which tracks the standard deviation in the valuation of a basket of Canadian cyclical resource companies, as measured by their price-to-book value and price-to-cash flow.

A couple of things jump out at me here.

One, there are a lot of “spikes” in resources: You can see how deeply cyclical the resource sector is by looking at how “choppy” the graph is – swings beyond one standard deviation are quite common.

Two, the spikes are exceptionally sharp: You can see also how steeply the performance rebounds after each setback. After each crisis, there’s a tremendous opportunity.

I suggest that we are at that moment (or very close to it) right now; the relative valuation of resource companies is about the same as it was in the global financial crisis. It seems wise to listen to the wisdom of Warren Buffett here: “Be fearful when others are greedy, and greedy when others are fearful.”

How can investors capitalize on this opportunity? I can think of several ways:

Low-cost ETFs

An easy choice, particularly for those with more modest portfolios. For quick, diversified, no-fuss exposure to a basket of national and international materials companies, this is the way to go, both in the Canadian market and in the United States.

Mining ‘majors’

The current troubles have taken a big toll on mining stocks and base-metals companies in Canada and other jurisdictions. In fact, many of the “majors” of the mining sector (think Teck Resources, Freeport-McMoRan, Barrick Gold, Glencore and others) have lost between 50 per cent and 85 per cent of their stock prices – that’s almost $1-trillion (U.S.) in market capitalization.

For those who like to “dig in” and do their homework, any or all of these could be intriguing opportunities. However, I would be extremely cautious about taking a “do-it-yourself” approach in the junior or speculative space – there’s just too much uncertainty about who’s going to close their doors permanently.

Active management

There have been legitimate criticisms levelled against active investing over the years. However, this is one example when active management makes a lot of sense, particularly if you’re interested in capturing opportunities in the junior space.

In a volatile industry with significant “blood on the streets,” I would rather have professionals guiding my money – professionals who can roll up their sleeves, meet company management face-to-face and screen for specific opportunities, rather than wait for the rising tide that lifts all boats.

One fund that has caught our eye is the Delbrook Resources Opportunities Fund, a long/short hedge fund with a concentrated portfolio of about 20 to 25 active positions. The fund’s unique approach is in the fund’s performance – it’s considerably better than its benchmark. Year to date, the fund is down 13.8 per cent compared with a loss of 27.7 per cent for the TSX Venture.

While the fund has had a slight uptick lately, we’re very much in the early innings of this opportunity.

Make no mistake, this is a specialized investment, to be added as a satellite position in a well-diversified portfolio and only suitable for veteran, high-net-worth investors who are not averse to taking risks. But it strikes me as exactly the kind of opportunity that crisis often creates.

For more information & additional links:

http://www.theglobeandmail.com/globe-investor/investment-ideas/how-investors-can-capitalize-on-the-resource-rout/article27790408/