Following her record $5M gift to uOttawa, Patricia Saputo shares her thoughts on the future of philanthropy

Philanthropy can be about more than doing something positive for others. It can also be a way of righting old wrongs.

When Patricia Saputo was in her early 20s, she had the world at her feet — or so it seemed. As the child of Francesco Saputo, one of the founders of the Montreal-based cheese empire, you might think her dream to study law at the University of Ottawa wasn’t far-fetched.

However, Patricia, one of five daughters from a conservative Sicilian family, was told that, as a woman, she couldn’t move to Ottawa and live on her own unless she was married.

Undeterred, she carved her own path, attending Concordia University in Montreal and becoming a preeminent tax accountant and adviser to enterprising families.

But she never forgot her desire to attend law school in Ottawa.

This memory recently led Patricia to donate $5 million to endow the Family Enterprise Legacy Institute (FELI) at the University of Ottawa, a program that, had it existed in her time, might have been the lifeline she needed.

“It was all personal, because it started with not being able to attend University of Ottawa and get a law degree. But it’s also personal because of all the work I do in the family office space, not just compliance and tax work, but on the human capital side as well,” she explains.

“In a lot of ways, it was a full circle moment. I think if a family enterprise program had existed, I would have attended every single one of them.”

When it comes to family offices, issues can go far beyond wealth. While succession, governance and administration are important, relationships and the varying needs, values and interests of family members can also play a role in future success. Special programs in the United States, such as the Wharton Family Wealth Program or the Kellogg Family Enterprise, seek to offer instruction and counsel to this unique group.

Meanwhile, in Canada, there was nothing — until FELI at the Telfer School of Business came along, following Patricia’s donation earlier this year.

Not only is it the first school of its kind north of the border, but Patricia’s $5-million donation is the largest ever made by a woman to the university.

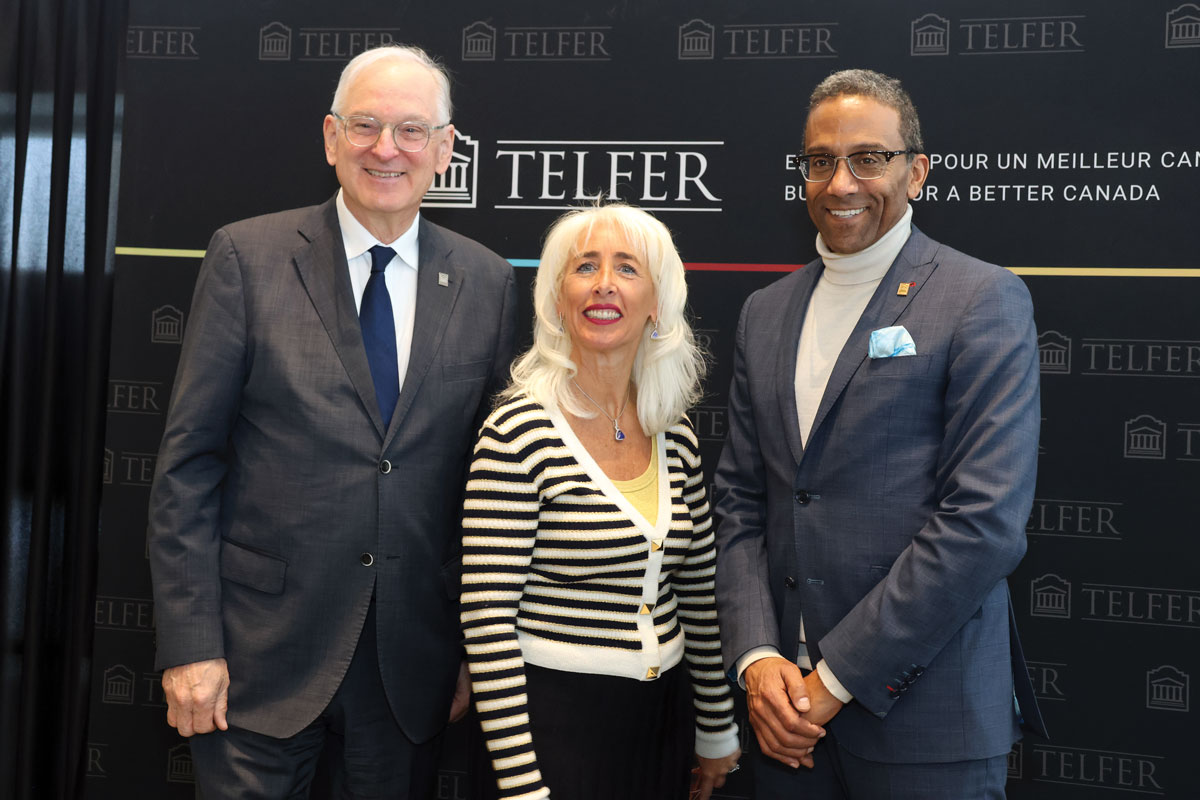

“Through her work, (Patricia) has become a leader growing and supporting family enterprises and the next generation of family leaders in Canada,” said Jacques Fremont, University of Ottawa’s president and vice-chancellor.

“God knows that family leaders are really making a difference in this country.”

Family-owned businesses account for 63.1 per cent of all private-sector firms in Canada and employ approximately 6.9 million Canadians. According to the Family Enterprise Foundation, ownership of more than 60 per cent of family enterprises will change hands in the next decade.

Such a historic transfer of wealth presents an opportunity, Patricia says. With her expertise in family wealth consulting, Patricia is acutely aware that the next generation has a unique chance to chart its own path and make a difference in society.

Her gift has allowed Peter Jaskiewicz, a full-time professor and researcher at the Telfer School of Management, to continue his work on crafting the modules and curriculum for FELI.

“There is one module we will be working on in November for the program,” Patricia adds. “Philanthropy usually comes at the end. So I am hoping it will be in there. And if it’s not, I will push for that. It needs to be.”

Patricia’s personal gift to the University of Ottawa is part of a trend among donors, especially those from family offices. Whereas in the past, families that had liquidity events might set up a charitable foundation due to the tax advantages, or to just tick a box, today’s generation of philanthropists are much more concerned with tangible impact.

“A lot of families, for example, have made their money in oil and gas,” she explains.

“The next generation feels, ‘Oh, we made our money on a dirty industry. How can we clean it up?’ So they want to give back in that way. How do we make good and make an impact now and undo what we did. There is more of a social conscience.”

Another huge change, Patricia adds, is the rise of social impact investing.

Rather than just giving money away, family offices and the new generation of philanthropists are more concerned with how they can invest their money to achieve societal change. Investment decisions are increasingly being made not just on a financial return, but on how it can help a particular community or segment of society.

In other words, giving for next generation has become more personal.

Of course, for Patricia, her record gift to the University of Ottawa is not for any financial return. Her measure of success, five or 10 years from now, will be seeing families enrolled in FELI and benefiting from its research and teachings. That perhaps, through the institute, future generations will not only be better enterprising families, but also become better people.

“It is all about the relationships in the family, not about the money,” Patricia explains.

“The money is there to help out so they can make the decisions that will really help them keep the family together. The money allows for a better life and to have more choices. And do something they enjoy doing, not because they have to do it, but because they want to. They can make a difference in their lives, the lives of their family, and the lives of the community.”

Jeff Todd is the president of AFP Ottawa Chapter and vice-president of marketing and communications for the WCPD Foundation.