Can mining and environmental causes be friends? Times are certainly changing

There was a time when mining exploration and the environment were like oil and water.

Several years ago, I attended social impact investing conferences in America and the U.K. with a crazy idea — junior mining exploration and the environment don’t have to be enemies. In fact, they are friends. I remember one conference at Oxford when I introduced myself to other delegates.

“Why are you here?”

“Are you kidding me? Mining is causing all of the problems with the environment.”

“I think you took a wrong turn.”

And that was just day one. By day two of the conference, I discovered that someone had logged a complaint against me. I wasn’t kicked out of the conference, but I was politely asked to leave.

Oh, how times have changed. I wasn’t naive enough to think that junior mining exploration didn’t have a negative impact on our environment. I understood the track record of this industry, the poor regulatory standards of the past, and, of course, its complicated relationship with Indigenous peoples. What I was trying to get across was far more complex. Those delegates were only thinking about the past. My mind was already on the future.

In 1954, the Canadian government introduced flow-through shares, a financial instrument that allows Canadians to invest in junior mining companies. Junior mining exploration is risky — most of the time, they find nothing on the other end of that drill. Therefore, to entice investment, the government offered Canadians a 100-per-cent tax deduction.

This policy has existed for 70 years, four years older than your RRSP. It played an important role in Canada’s emergence as a mining superpower, adding billions to our GDP and thousands of jobs annually.

The next big moment in history came on May 2, 2006. Then prime minister Stephen Harper removed the capital gain tax on the donation of public stock, paving the way for our firm to perform the first-ever charity flow-through transaction.

Rather than someone holding onto that volatile junior mining share, they could donate it to charity and receive a second 100-per-cent tax receipt. Then, that stock could be immediately sold to a pre-arranged liquidity provider, or institutional buyer of mining shares, at a discount.

The result? No stock market risk for the donor.

When you combine those two 100-per-cent tax deductions, plus additional federal and provincial tax credits, our clients can receive a large tax deduction and pass on those savings to charities of their choice. In rough terms, the average donor can bring the cost to give one dollar down from 50 cents (if you receive a 100-per-cent tax deduction for a donation, at the highest marginal tax rate) to as low as a penny.

There is also a for-profit option, known as a buy-sell, where the client can immediately sell the stock at that discount, keep the cash and receive all the tax deductibility.

Our innovation in 2006 sparked an entirely new industry for charity flow-through shares, resulting in billions of new donations for Canadian charities and billions more for junior mining exploration.

It was the latter that got me kicked out of that conference in Oxford. Sure, you are creating jobs, boosting the economy and helping charities. But the environment is suffering.

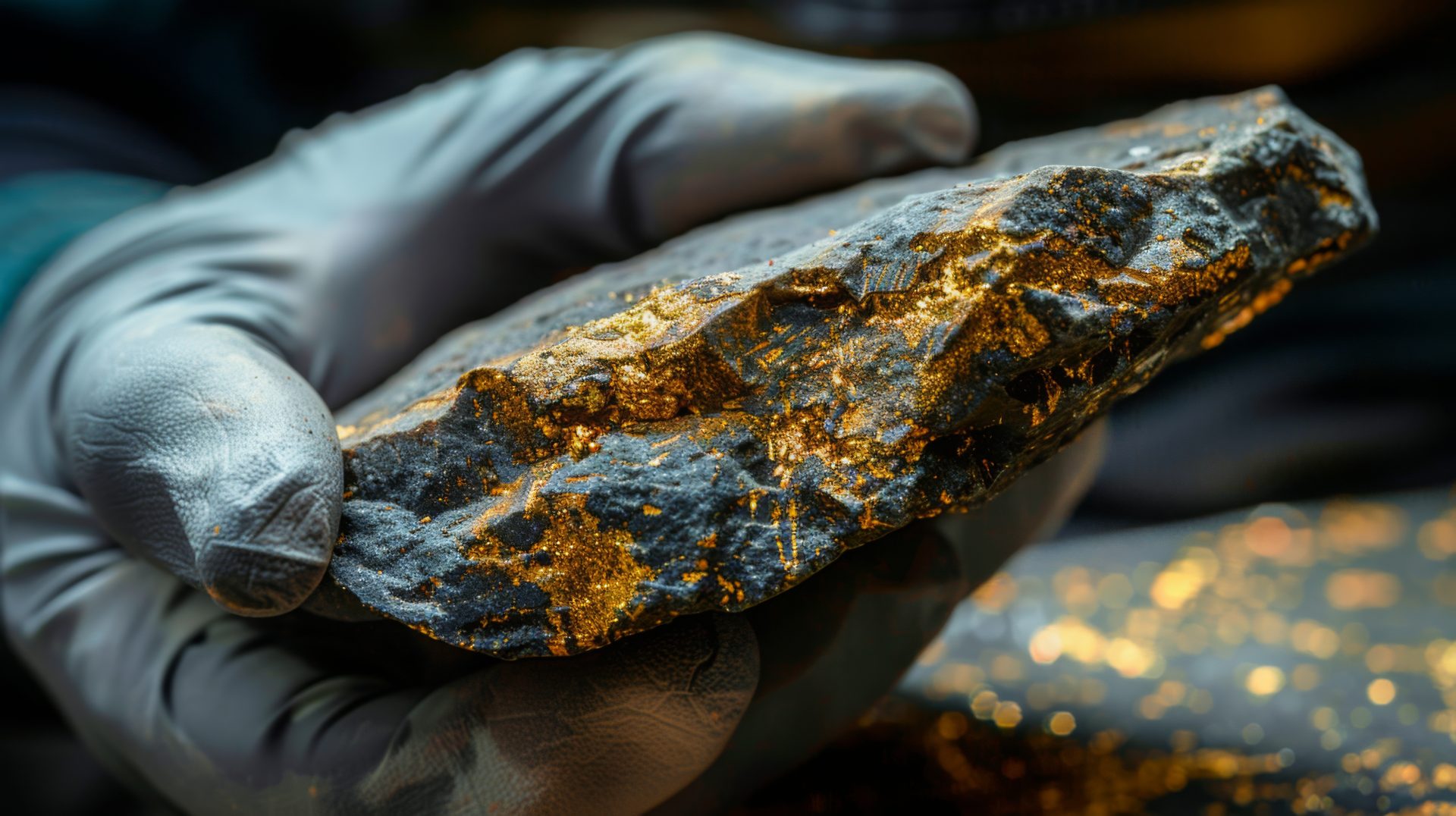

What I told them, at the time, was that charity flow-through shares rarely deal in oil and gas. And today, charity flow-through for oil and gas no longer even exists. Most exploration involves minerals such as copper, zinc, cobalt or nickel. Yes, mining can hurt the environment. But how else can we build solar panels, windmills and electric cars?

Nobody thought about electric cars back then. Green energy, for the most part, was still in the realm of science fiction for most people. That is, until Canada’s 2022 federal budget. Chrystia Freeland, deputy prime minister and minister of finance, announced a critical mineral strategy to help supercharge our path to a low-carbon future.

In addition to the existing tax deductions for charity flow-through shares, the government introduced a new 30-per-cent federal tax credit (equivalent to a 60-per-cent deduction) on any projects exploring for critical minerals. It also announced billions more in critical mineral infrastructure and supply chains.

The government’s plan? That our abundance of critical minerals and the transition to a green energy economy will slowly replace the economic value of the oil sands industry. As we wean ourselves off fossil fuels, energy transition metals will step into their place. Suddenly, mining isn’t so scary anymore.

“I have to say, on a personal level, I’m having this strange experience of sitting on this couch and talking about the virtues of mining,” said Rick Smith, president of the Canadian Climate Institute, noted environmentalist and celebrated author. “Some of you may know, I started my career in 1988 in the environmental field, chained to a tree in Temagami before I was carted away by the OPP. This ivory cream-coloured couch is an enduring testament to the changing nature of this discussion we’re having.”

Smith said these words during a recent panel discussion at my home, when we hosted nearly 100 delegates from the Philanthropic Foundations Canada’s (PFC) annual conference in Ottawa. PFC, which represents all the large, private foundations in Canada, joined us to discuss how foundations can tackle climate change.

“But now we’re friends,” I responded, followed by laughter from the crowd. It was a poignant moment for me, as someone who has been in this business for so long.

In a recent report released by the Canadian Climate Institute, it was noted that global demand for six critical minerals will reach $770 billion per year by 2040. Meanwhile, it is estimated that Canada needs $30 billion in investment for critical mineral exploration. These are eye-watering numbers.

In an average year, my firm, along with our friendly competitors, might do $1.2 billion in financing for these mineral companies. Add to that, charity flow-through providers account for nearly 90 per cent of all junior mining company exploration in Canada. Our structure is that effective — and important — for critical mineral exploration. But the reality is, it’s not nearly enough.

Nevertheless, old habits and perceptions die hard. And, in some cases, rightfully so. By definition,mining requires us to alter the land. Meanwhile, relationships between mining companies and Indigenous groups can be strained as they negotiate the mineral royalty payments and use of the land. Mining is not and will never be perfect.

Just as Canadians need to accept that critical minerals exploration is necessary for a green energy transition, so too does industry need to make an effort toward sustainability. The government also plays a role. More must be done to incentivize investment in exploration, create positive relationships with Indigenous groups, and cut red tape so exploration sites can bring materials to market.

If we are to reach a low-carbon future and create a green energy infrastructure, we can no longer work in silos. We all must play for the same team.

For decades, Peter Nicholson has been a recognized leader in Canadian tax-assisted investments, with a specialized focus on philanthropic tax planning and tax reduction. Through his work with donors, foundations, institutions and boards, he has helped generate in excess of $350 million in client donations. To learn more about how WEALTH (WCPD Inc.) can assist your tax and philanthropic goals, write Peter.Nicholson@wcpd.com.